The promissory note is a well-known financial instrument among professionals, especially those involved in payment management and debt collection. However, although this tool is frequently used in commercial relationships, many administrative managers, business owners, and collection agents do not fully understand its nuances. In this article, we will provide a detailed explanation of how a promissory note works, its advantages and risks, and its practical applications in collection operations. We have also published a more general article on how to Accelerate Your B2B Payments with Secure Payment Methods.

What Is a Promissory Note?

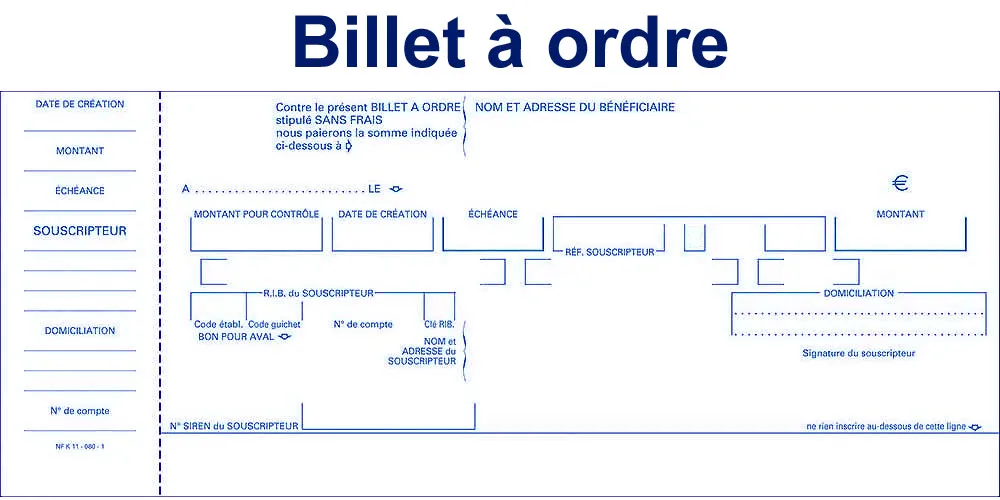

A promissory note is a written acknowledgment of debt, in which a debtor commits to paying a specified amount of money to a designated beneficiary on a certain due date. Unlike a bill of exchange, where the creditor issues the payment request, here it is the debtor who initiates this payment commitment. This gives the promissory note a unilateral nature, involving a firm promise to settle the debt on a specific date.

This instrument is commonly used by SMEs, large companies, and merchants, particularly when it comes to managing commercial debts. Due to its flexibility and well-defined legal framework, it is often used in B2B transactions to defer payments while providing a form of guarantee to the creditor.

Essential Characteristics of a Promissory Note

To be valid, a promissory note must meet certain conditions and include mandatory elements. These characteristics are crucial to ensure that the promissory note is legally valid and can serve as evidence in case of a dispute or non-payment.

Here are the mandatory elements a promissory note must include:

- The promise to pay: The promissory note must clearly and unequivocally contain a promise to pay a specific amount of money.

- The due date: The document must state the date on which the payment will be made. If no date is specified, the note is payable on demand, meaning immediately upon request.

- The place of payment: It is important to specify where the payment will take place. This could be at the creditor’s headquarters or another location agreed upon by the parties.

- The beneficiary: The name of the beneficiary, i.e., the person or company who will receive the payment, must be listed on the note.

- The date and place of issuance: The note must indicate the date it was issued and the place where it was signed.

- The signature of the issuer: The debtor must sign the document to validate their commitment.

Benefits of a Promissory Note for Businesses

Using a promissory note offers several advantages for both the debtor and the creditor, making it a popular tool in commercial negotiations and debt collection.

Flexibility in Debt Repayment

One of the main benefits of a promissory note is the flexibility it offers the debtor. Unlike other payment methods like checks, the debtor is not required to have the necessary funds available in their account when the note is issued. The amount only needs to be available by the due date, giving the debtor additional time to gather the funds.

A Guarantee for the Creditor

For the creditor, the promissory note represents a firm promise of payment, backed by a clear legal framework. If the payment is not made by the due date, the creditor can take legal action to recover the debt, such as filing for a court-ordered payment or seizing the debtor’s assets. This provides a certain level of security, especially in cases involving large amounts or clients with uncertain solvency.

Endorsement and Transfer of the Promissory Note

A promissory note can be endorsed, meaning it can be transferred to a third party, such as a supplier or a bank. This allows the original creditor to transfer their claim. This mechanism is particularly useful in discounting operations, where a business can obtain immediate liquidity by transferring its promissory note to a financial institution in exchange for cash.

Ease of Use

Whether issued in paper form or electronically (as a “promissory note summary”), this document is simple to create. The electronic version offers the advantage of smoother and faster management, while also avoiding the risks of loss or damage associated with physical paper notes.

Risks of Using a Promissory Note

Despite its advantages, the promissory note is not without risks, particularly for the creditor. Companies considering using this instrument should be aware of certain limitations.

Risk of Non-Payment

The primary risk is, of course, non-payment by the due date. As mentioned earlier, the debtor is not required to have the necessary funds available at the time the note is issued. Therefore, if the funds are not available by the due date, the creditor may find themselves in a difficult situation. In such cases, they will need to initiate a collection process, which is often lengthy and costly.

Legal Formalities

A promissory note must adhere to certain formalities. If any of the required elements (such as the due date or the issuer’s signature) are missing, the document may be considered invalid, depriving the creditor of their legal protection. Special attention must therefore be paid to the drafting of the note.

Transfer of Risk

When a promissory note is endorsed, the creditor not only transfers their rights but also the risks associated with collecting the debt. If the new holder of the note is unable to collect payment, this can complicate the original commercial relationship between the creditor and the debtor.

How to Issue and Cash a Promissory Note

Issuing a promissory note is relatively simple but requires strict adherence to legal standards.

Issuing the Note

To issue a promissory note, the debtor must first negotiate the terms with the creditor, particularly regarding the payment due date. Once the agreement is reached, the debtor drafts the note, ensuring that all mandatory information is included. It is recommended to keep a duplicate of the document for internal records.

Cashing the Note

The creditor can cash a promissory note either on the due date or on demand, depending on the agreed terms. To do so, the creditor presents the note to their bank, which will debit the debtor’s account and credit the creditor’s account. If the debtor does not have sufficient funds on the due date, the bank may refuse to process the payment.

Remedies in Case of Non-Payment

In the event of non-payment by the due date, the creditor has several options to recover the amount owed.

Attempt to Collect Amicably

Before initiating legal action, it is often advisable to attempt an amicable recovery by contacting the debtor directly. This approach helps maintain the business relationship and avoid additional legal costs.

Legal Remedies

If amicable collection fails, the creditor can turn to the courts to obtain a payment order. This procedure allows the creditor to quickly obtain an enforceable title, authorizing them to seize the debtor’s assets if payment is not made.

Conclusion

The promissory note is a powerful tool in managing commercial debts, offering both flexibility and security for businesses. However, like any financial instrument, it carries risks, particularly in the event of non-payment. For business owners, administrative managers, and collection agents, it is essential to understand how it works and to comply with the required formalities to maximize its benefits while minimizing risks.

To delve deeper into this topic, check out our strategic guide on securing receivables and managing client risk, which provides a comprehensive overview of tools and best practices to implement.