Billabex is Now Available on AWS Marketplace!

Announcing Billabex on AWS Marketplace! Automate accounts receivable and accelerate cash flow with our intelligent AI agent. Simplify procurement

Read articleResources

Optimize your cash flow and speed up invoice collection with our practical tips, software comparisons, templates, tools, techniques, testimonials, and case studies.

Categories

Announcing Billabex on AWS Marketplace! Automate accounts receivable and accelerate cash flow with our intelligent AI agent. Simplify procurement

Read article

Discover how AI and robotics are transforming debt collection, streamlining financial operations, and boosting cash flow in industries.Explore the impact

Read article

Explore the role and benefits of debt collection agencies, key steps in the process, and current trends in the industry to improve cash flow management.

Read article

Unpaid invoices in US education: explore the crisis impacting schools, students, and training. Learn strategies to tackle this financial strain.

Read article

Comprehensive analysis of unpaid medical bills in the US: causes, impacts on patients & providers, regulations, and effective strategies. Learn how

Read article

US retail debt collection in 2025. Learn expert strategies for managing unpaid accounts, navigating the FDCPA, leveraging tech, and boosting cash flow

Read article

Unpaid invoices hurting your US transport business? Discover expert strategies to manage late payments, improve logistics cash flow & get paid faster.

Read article

Facing late construction payments in the US? Learn why it's a $280B crisis & discover legal remedies & proactive strategies to secure your cash flow now.

Read article

Learn how late invoice payments affect restaurant suppliers and discover practical solutions to tackle this issue. Essential tips for industry professional

Read article

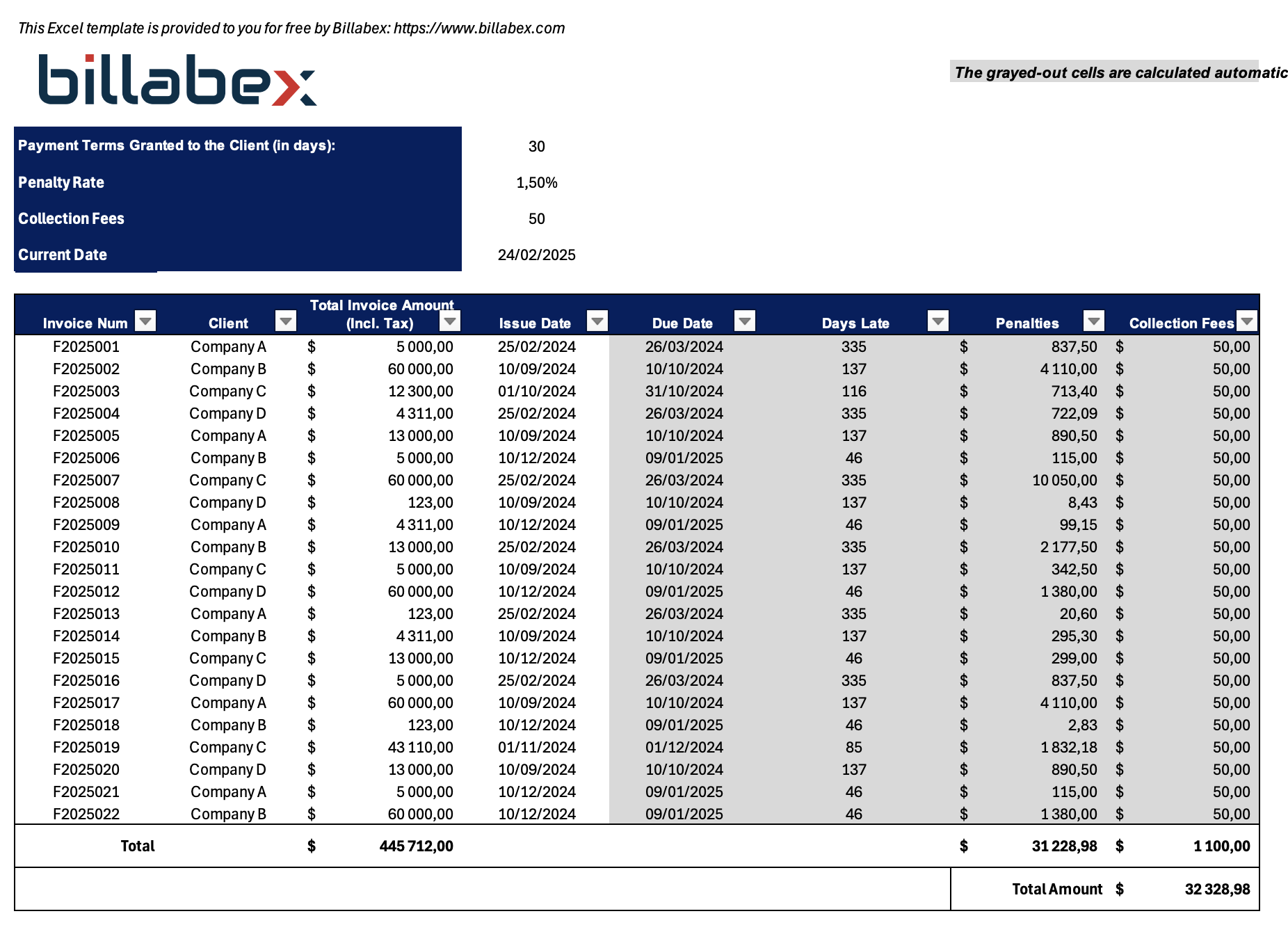

Protect your business from late payments. Explore invoice penalty laws by state, proven strategies, and a free Excel calculator. Boost your cash flow today

Read article

Discover expert strategies to manage hotel unpaid invoices and boost financial stability. Learn how to prevent payment delays and enhance revenue.

Read article

Discover how debt collection software can optimize cash flow, automate overdue payments, and simplify debt management for businesses of all sizes.

Read articlePage 1 / 7